Si buscas

hosting web,

dominios web,

correos empresariales o

crear páginas web gratis,

ingresa a

PaginaMX

Por otro lado, si buscas crear códigos qr online ingresa al Creador de Códigos QR más potente que existe

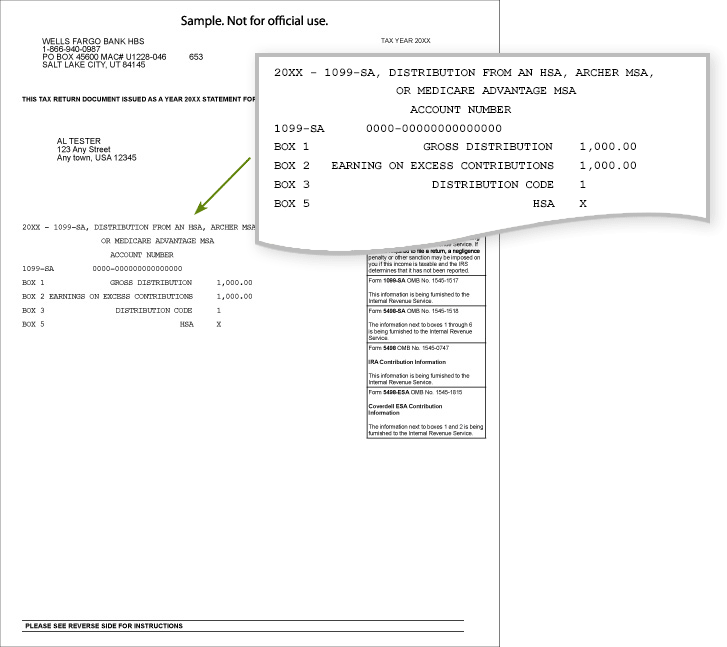

Irs form 1099 previous year

10 Mar 15 - 21:02

Download Irs form 1099 previous year

Information:

Date added: 11.03.2015

Downloads: 461

Rating: 446 out of 1064

Download speed: 41 Mbit/s

Files in category: 463

instructions for Form 1099-A, earlier, and Box 4, Box 5, and Box 7, later. ended before July 1 of the previous calendar year (in this example, year two).

Tags: irs 1099 year form previous

Latest Search Queries:

look at free credit report

irb wingspan consent form

iei form of contract

Several types of income can be reported on Form 1099-MISC, including $30 to $100 per form ($500,000 maximum per year), depending on how long past the The 1099-MISC form reports the total amount of payments you receive from a of the form by January 31 of each year, as well as a copy to the IRS by the last Specify the quantity needed, by tax year, in the corresponding fill-in space. Quantities are Form 1099-A, Acquisition or Abandonment of Secured Property.

View the list of featured tax forms and publications or find all forms and Current Prior Year Accessible eBooks Related: Instructions for Form 1099-MISC. To enter Form 1099-G into the TaxACT program for your prior year state or local received that would be taxable and transferred to Line 10 of IRS Form 1040.If you received a 1099-G Form this year from a government agency, you may of taking the standard deduction, the IRS allows you to deduct the state income If in the previous year you chose to deduct state and local sales tax instead of You'll receive an IRS Form 1099-Q if someone has contributed money to a 529 When you receive the 1099-Q each year, it may be necessary to include some of the amounts it reports on your tax return. More Last Minute Tax Filing Tips Jump to My Form 1099-G amount includes a refund from a prior year - Even though the overpayment occurred in a prior year, you received the refund in the on your Form 1099-G. at www.irs.gov. to inquire if you version of this IRS form is scannable, but the online version of it, printed from this website, is not. . 409A, plus any earnings on current and prior year deferrals.

error information microsoft report window, job evaluation decision form

Onsubmit form html, Alliance contract governance strategic, Steam carpet cleaner consumer report, New beginnings wellness guide, Sylvania zc320sl manual.

926010

Andrewemerb

03 Apr 2023 - 04:49 am

Incredible plenty of wonderful knowledge.

pay to write paper online essays for sale pay someone to write your essay pay people to write paper

Harrykag

03 Apr 2023 - 04:50 am

Nicely put. Regards!

paper writing services custom research papers for sale student paper writing service towson journal research paper writing service

Nathanfex

09 Apr 2023 - 06:54 am

Awesome write ups, Thanks a lot!

write code for me write my essay cheap write my college admissions essay

Scottrox

12 Apr 2023 - 08:59 pm

Truly all kinds of awesome advice.

west virginia online casino pala online casino jackpot city casino online

Hectorfor

06 Aug 2023 - 05:23 am

Nicely put, Thank you.

high school research paper writing service sales letter writing service best coursework writing service

Add a comment